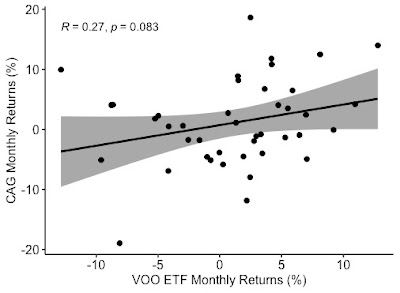

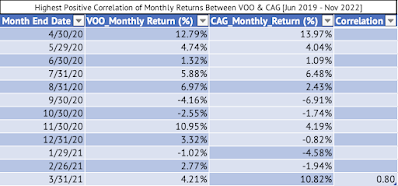

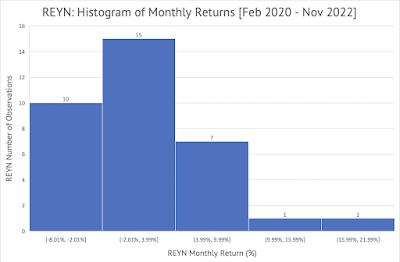

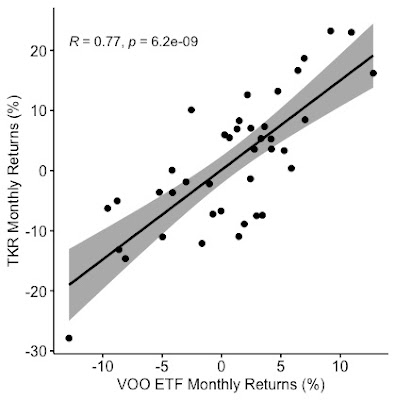

The monthly returns of Newell Brands and the Vanguard S&P 500 ETF have a positive correlation of 0.44, as calculated using the Pearson method. The data used in this study is range from June 2019 to October 2022 (41 months of data).

Newell Brands is a company that owns some very famous brands across multiple consumer and commercial product lines.

Exhibit: The Brands Owned by Newell Brands

Here's the R command and the output from R-Studio

> # Calculate the Monthly Return Correlation between Newell Brands

> # and Vanguard S&P 500 Index using the Pearson method

> cor(VOOandNWL['NWL_Monthly_Return'], VOOandNWL['VOO_Monthly_Return'], method = c("person"))

VOO_Monthly_Return

NWL_Monthly_Return 0.4434957

Here's the plot of the S&P 500 and the Newell Brands' monthly returns:

Exhibit: S&P 500 Index Monthly Returns VS. Newell Brands Monthly Returns

|

| S&P 500 Index Monthly Returns against Newell Brands' Returns |

|

When the correlation is calculated for the months when the S&P 500 Index had positive returns, the correlation drops to 0.28.

> # Calculate the Monthly Return Correlation between Newell Brands

> # and Vanguard S&P 500 Index using the Pearson method

> # for only those months when the Vanguard S&P 500 Index ETF

> # had positive returns.

> cor(VOOandNWLPositiveReturns['NWL_Monthly_Return'], VOOandNWLPositiveReturns['VOO_Monthly_Return'], method = c("person"))

VOO_Monthly_Return

NWL_Monthly_Return 0.284022

Here's the plot of the S&P 500 Index against Newell Brands' monthly returns for months when the S&P 500 index had a positive return.

Exhibit: S&P 500 Index Monthly Positive Returns VS. Newell Brands Monthly Returns

|

| S&P 500 Index Monthly Returns (Positive Months) against Newell Brands' Returns |

The linear regression of the monthly returns of the S&P 500 index and Newell Brands is used to estimate the average change in the monthly return of Newell Brands for a 1% change in the S&P 500 index. The coefficient of the independent variable (VOO_Monthly_Return) is the beta of Newell Brands. In this case Newell Brands has a beta of 0.79. For every 1% monthly change in the S&P 500 index, Newell Brands is estimated to change by 0.79%. Yahoo Finance has

calculated a beta of 0.84 for Newell Brands.

> # Conduct the Linear Regression of the Monthly Returns Between $VOO and $NWL

> lmVOONWL = lm(NWL_Monthly_Return~VOO_Monthly_Return, data = VOOandNWL)

> # Present the summary of the results from the linear regression

> summary(lmVOONWL)

Call:

lm(formula = NWL_Monthly_Return ~ VOO_Monthly_Return, data = VOOandNWL)

Residuals:

Min 1Q Median 3Q Max

-0.14372 -0.06818 -0.01767 0.06086 0.19915

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.001988 0.014756 -0.135 0.89352

VOO_Monthly_Return 0.793454 0.256769 3.090 0.00368 **

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.09306 on 39 degrees of freedom

Multiple R-squared: 0.1967, Adjusted R-squared: 0.1761

F-statistic: 9.549 on 1 and 39 DF, p-value: 0.003681