Saturday, November 26, 2022

Monthly Return Comparison Between Cummins and Vanguard S&P 500 Index ETF

Tuesday, November 22, 2022

Beta of Various Stocks Listed in the US

I have calculated the beta of a few more stocks. Here's the latest list as of November 22, 2022. The one-year returns of Timken and Newell Brands are based on closing prices as of November 22.

Exhibit: Beta of Various Stocks Listed in the U.S.

|

| Click on the image to see beta values. (Source: Data Provided by IEX Cloud, Author's Analysis Using RStudio, Yahoo! Finance) |

Stocks in this list:

- Cisco

- Colgate

- Lennox

- Sealed Air

- Boeing

- Newell Brands

- Timken

Volatility of Monthly Returns of Newell Brands Compared to the Vanguard S&P 500 Index ETF

The monthly returns of Newell Brands and the Vanguard S&P 500 ETF have a positive correlation of 0.44, as calculated using the Pearson method. The data used in this study is range from June 2019 to October 2022 (41 months of data).

Newell Brands is a company that owns some very famous brands across multiple consumer and commercial product lines.

Exhibit: The Brands Owned by Newell Brands

|

| (Source: Newell Brands) |

Here's the R command and the output from R-Studio

> # Calculate the Monthly Return Correlation between Newell Brands

> # and Vanguard S&P 500 Index using the Pearson method

> cor(VOOandNWL['NWL_Monthly_Return'], VOOandNWL['VOO_Monthly_Return'], method = c("person"))

VOO_Monthly_Return

NWL_Monthly_Return 0.4434957

Here's the plot of the S&P 500 and the Newell Brands' monthly returns:

Exhibit: S&P 500 Index Monthly Returns VS. Newell Brands Monthly Returns

| |

(Source: Data Provided by IEX Cloud, Correlation and Graph on RStudio) |

When the correlation is calculated for the months when the S&P 500 Index had positive returns, the correlation drops to 0.28.

> # Calculate the Monthly Return Correlation between Newell Brands

> # and Vanguard S&P 500 Index using the Pearson method

> # for only those months when the Vanguard S&P 500 Index ETF

> # had positive returns.

> cor(VOOandNWLPositiveReturns['NWL_Monthly_Return'], VOOandNWLPositiveReturns['VOO_Monthly_Return'], method = c("person"))

VOO_Monthly_Return

NWL_Monthly_Return 0.284022

Here's the plot of the S&P 500 Index against Newell Brands' monthly returns for months when the S&P 500 index had a positive return.

Exhibit: S&P 500 Index Monthly Positive Returns VS. Newell Brands Monthly Returns

|

| S&P 500 Index Monthly Returns (Positive Months) against Newell Brands' Returns |

> # Conduct the Linear Regression of the Monthly Returns Between $VOO and $NWL

> lmVOONWL = lm(NWL_Monthly_Return~VOO_Monthly_Return, data = VOOandNWL)

> # Present the summary of the results from the linear regression

> summary(lmVOONWL)

Call:

lm(formula = NWL_Monthly_Return ~ VOO_Monthly_Return, data = VOOandNWL)

Residuals:

Min 1Q Median 3Q Max

-0.14372 -0.06818 -0.01767 0.06086 0.19915

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.001988 0.014756 -0.135 0.89352

VOO_Monthly_Return 0.793454 0.256769 3.090 0.00368 **

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.09306 on 39 degrees of freedom

Multiple R-squared: 0.1967, Adjusted R-squared: 0.1761

F-statistic: 9.549 on 1 and 39 DF, p-value: 0.003681

Saturday, October 1, 2022

Volatility of Monthly Returns of Timken Compared to the Vanguard S&P 500 Index ETF

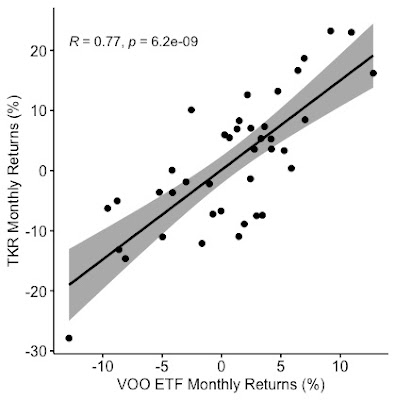

Here is the graph of monthly returns between June 2019 and September 2022 of Timken (TKR) plotted against Vanguard S&P 500 Index ETF (VOO):

Exhibit: Monthly Returns of VOO and TKR between June 2019 and September 2022

The monthly returns of Timken have a very strong positive correlation of 0.77 with the S&P 500 Index. The very low p-value (p = 6.2e-09) indicates that the monthly returns of the S&P 500 Index have an effect on Timken's monthly returns.The Beta value indicates the monthly return volatility of Timken compared to the S&P 500 Index. Yahoo Finance provides a Beta value of 1.59 based on monthly returns over the past five years. A linear regression of the monthly returns between June 2019 and September 2022 yields a Beta of 1.48. The coefficient of Vanguard's monthly return is the volatility of Timken. The coefficient is the linear regression line's slope and Timken's Beta value. In other words, as the monthly return of the Vanguard S&P 500 Index ETF changes by 1%, Timken's monthly return can change by an average of 1.48%.

Timken's Beta value is one of the highest I have seen. Here are the Beta values of some of the stocks in another post on this blog.

Here's the output of the linear regression between the monthly returns of Vanguard S&P 500 Index ETF and Timken:

Call:

lm(formula = TKR_Monthly_Return ~ VOO_Monthly_Return, data = VOOandTKR)

Residuals:

Min 1Q Median 3Q Max

-0.132602 -0.047815 -0.000585 0.059694 0.137770

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.001198 0.011348 0.106 0.916

VOO_Monthly_Return 1.489061 0.199966 7.447 6.17e-09 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.07103 on 38 degrees of freedom

Multiple R-squared: 0.5934, Adjusted R-squared: 0.5827

F-statistic: 55.45 on 1 and 38 DF, p-value: 6.168e-09

Thursday, September 29, 2022

Beta for Boeing, Sealed Air, Lennox International, Colgate-Palmolive & Cisco

I write about various companies on Seeking Alpha, covering Sealed Air, Lennox, Colgate-Palmolive, and Cisco Systems. I calculated the Beta of the monthly returns for these stocks compared to the Vanguard S&P 500 Index. Here's the table showing the beta:

Exhibit: Beta of Cisco, Colgate-Palmolive, Lennox International, Sealed Air, and Boeing

| The beta of Cisco, Colgate-Palmolive, Lennox International, Sealed Air, and Boeing |

You can read my articles on Seeking Alpha, which needs a subscription, by following the links below:

- Sealed Air: Misclassified and Misunderstood

- Cisco Systems: Great Margins, But Lacks Growth

- Colgate-Palmolive Stock is Overvalued

- Lennox International May be Fully Valued

Tuesday, September 27, 2022

Boeing's Monthly Return Volatility Compared to the Vanguard S&P 500 Index ETF From June 2019 to August 2022

Given its dominant position in the aerospace market, one would think Boeing's (BA) monthly returns would be less volatile than the S&P 500 index (VOO). But, Boeing has endured a lot in the past few years. First came the trade war with China that froze Boeing out of the second-largest aerospace market in the world. Then came the COVID-19 pandemic that grounded airlines worldwide and brought Boeing to its knees. We did not even talk about the 737 Max plane crash in Ethiopia that kicked off the disastrous few years for Boeing.

Boeing has never fully recovered from either the trade war or the pandemic. Boeing remains frozen out of the Chinese market, and airlines are only now seeing air travel return close to pre-pandemic levels (Exhibit 1).

Exhibit 1: TSA Checkpoint Travel Number September 17, 2022 - September 26, 2022

|

| TSA Checkpoint Travel Numbers (Source: TSA.GOV) |

|

| Vanguard S&P 500 Index ETF and Boeing Monthly Returns [June 2019 - August 2022] (Source: Data Provided by IEX Cloud, Author Calculations Using RStudio) |

Here's the output from the linear regression conducted on RStudio:

> lmBAVOO = lm(BA_Monthly_Return~VOO_Monthly_Return, data = VOOandBA)

> summary(lmBAVOO)

Call:

lm(formula = BA_Monthly_Return ~ VOO_Monthly_Return, data = VOOandBA)

Residuals:

Min 1Q Median 3Q Max

-0.26036 -0.07433 -0.00562 0.07323 0.33452

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.02348 0.02007 -1.169 0.249682

VOO_Monthly_Return 1.35442 0.36247 3.737 0.000628 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.1229 on 37 degrees of freedom

Multiple R-squared: 0.274, Adjusted R-squared: 0.2543

F-statistic: 13.96 on 1 and 37 DF, p-value: 0.0006279

Wednesday, September 21, 2022

Linear Regression of Monthly Returns of Sealed Air Corp and the Vanguard S&P 500 Index ETF

Sealed Air Corporation is a global provider of packaging solutions to various industries. The company provides various packaging products to pack red meat, medical and life science products, cheese, electronics, and other products.

Exhibit: Sealed Air Corporation Revenue by Region and Product Type

|

| (Source: Sealed Air Q2 FY 2022 Investor Presentation on August 2,2022) |

![Monthly Returns of Sealed Air Corp. and Vanguard S&P 500 Index ETF [June 2019 - August 2022] Monthly Returns of Sealed Air Corp. and Vanguard S&P 500 Index ETF [June 2019 - August 2022]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiSotWsT6tTgW3luCt3iEODsOGn6pJipMggQ7pPQGYBcAlf4iKukfkRVUeQTsczXHCcnq-UB_KpqWfO6NICzwZRHWTbICKW2ksTSfIdmfzWYYUIr90GSUdM-1qhnJEvdLRNsVhDXAAWzyOGc9w6Z_eA8TH0eMf13oaLwvQubU0-3lrLsvAe2sv0F7lu/w400-h315/Rplot01.jpeg) |

| Monthly Returns of Sealed Air Corp. and Vanguard S&P 500 Index ETF [June 2019 - August 2022] |

Tuesday, September 20, 2022

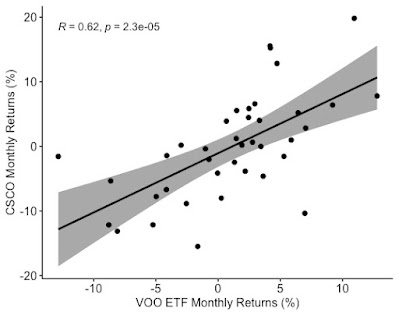

Linear Regression of Monthly Returns of Cisco Systems and the Vanguard S&P 500 Index ETF

Here is the graph of monthly returns of Cisco Systems (CSCO) plotted against Vanguard S&P 500 Index ETF (VOO):

Exhibit 1: Monthly Returns of Cisco Systems and Vanguard S&P 500 Index ETF [June 2019 - August 2022]

|

| Monthly Returns of the Vanguard S&P 500 Index ETF and Cisco Systems Inc. |

Sunday, September 18, 2022

Musings on Economic Growth, Buybacks, and Inflation

We are entering an era of slow growth, especially in the U.S. and Europe. The older demographics and lower productivity are to blame for the low growth. Economic growth was already slow in the 2010s, but artificially low-interest rates from the Fed caused multiple expansions in the stock market. I see these Asset Managers and VCs criticize the Fed and the Government for inflation today, but those guys did not give credit to the Fed and the Government for all the billions they made in profits due to the cheap money policies. Homeowners benefited from the artificially low-interest rates, but most would never call it a hand-out.

Business Insider is reporting that the corporate bond market is in deep trouble. CEOs spent $1 trillion on share buybacks each year to pad their income while their company's balance sheets deteriorated. Oracle spent over 85% of its operating cash flow on share repurchases. Even after all these buybacks, Oracle's stock is way down. No amount of financial engineering can save a company with zero revenue growth.

Oracle can afford buybacks, but many other companies were spending more than their operating cash flow on buybacks and dividends. Essentially, they borrowed money at ultra-low interest rates to fund their buybacks. Even after all these buybacks, Oracle's stock is way down. No amount of financial engineering can save a company with zero revenue growth.

The Biden administration should not bail out corporations for their mistakes and let companies go through the bankruptcy process for the way they mishandled shareholder wealth. We might see a wave of bankruptcies next year (2023). Let's return to our capitalist roots. It was a mistake to bail out AIG with $170 billion during the 2008 crisis. We spent trillions bailing out corporations for their mistakes in both 2008 and again in 2020. The US airlines went bankrupt in a week during March 2020. The US airlines spent all their money on buybacks and had nothing saved for a rainy day. I saw this ad from a Japanese company during the 2020 COVID crisis. They asked applicants to apply to their company and said employees need not worry about getting paid. They said they have enough money on their balance sheet to pay every employee even if they had zero revenues for 20 years.

Most of the inflation is caused by supply chain disruptions to food supplies and other essentials. No amount of lowering the money supply will reign in inflation caused by supply chain disruptions in food unless we want people to suffer from hunger.

Our problem will be slower economic growth and not inflation a year from now (2023). Inflation will be high compared to the 2010s, but it will settle at a much lower level than its current rate of 6% to 8%. Even this higher level will most likely be due to supply-side challenges. The money supply is already contracting rapidly.

Analyze Earnings Press Releases Using Snowflake Cortex LLM SQL Functions

Snowflake Cortex AI Product Stack (Source: Snowflake) 📊 Are you an asset manager, investment professional, or anyone dealing with large ...

-

Paccar ( PCAR ) produced 185,900 trucks in 2022 and is on track for another record year in 2023. The company has experienced good revenue ...

-

Summary: Describe the AI money flow using an illustration. How much do Adobe, Salesforce, and others spend on Research and Development (R...

-

Summary: A brief description of VWAP and its importance in trading and asset management. The process to calculate VWAP. An overview of the ...