Here's the histogram of monthly returns for Eastman Chemical (EMN) between June 2019 and November 2022 (Exhibit 1). Please click on the image to see an enlarged version.

Exhibit 1:

|

| Eastman Chemical Histogram of Monthly Returns (Source: Data Provided by IEX Cloud, Author Calculations using Microsoft Excel) |

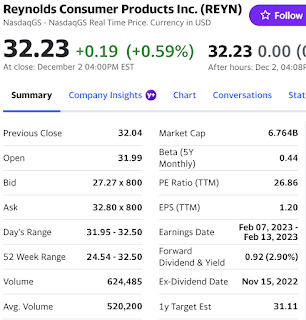

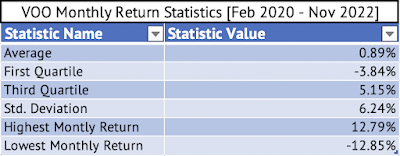

The average monthly returns of Eastman Chemical are slightly better than that of the Vanguard S&P 500 Index ETF (Exhibit 2 & 3). But Eastman Chemical has a much higher (nearly double) standard deviation (volatility) of monthly returns than the Vanguard S&P 500 Index ETF.

Exhibit 2:

|

| Eastman Chemical Average, First Quartile, Third Quartile, and Standard Deviation of Monthly Returns. (Data Provided by IEX Cloud, Author Calculations Using Microsoft Excel) |

|

| Vanguard S&P 500 Index ETF Average, First Quartile, Third Quartile, and Standard Deviation of Monthly Returns. (Data Provided by IEX Cloud, Author Calculations Using Microsoft Excel) |

Eastman Chemical moves closely with the market since it has a high positive correlation of 0.78.

> cor(VOOandEMN['EMN_Monthly_Return'], VOOandEMN['VOO_Monthly_Return'], method = c("pearson", "kendall", "spearman"))

VOO_Monthly_Return

EMN_Monthly_Return 0.7898654

A linear regression model of the monthly returns of Vanguard S&P 500 Index ETF as the independent variable and Eastman Chemical as the dependent variable yields a beta of 1.54.

> # Conduct the Linear Regression of the Monthly Returns Between $VOO and $EMN

> lmVOOEMN = lm(EMN_Monthly_Return~VOO_Monthly_Return, data = VOOandEMN)

> # Present the summary of the results from the linear regression

> summary(lmVOOEMN)

Call:

lm(formula = EMN_Monthly_Return ~ VOO_Monthly_Return, data = VOOandEMN)

Residuals:

Min 1Q Median 3Q Max

-0.12433 -0.04969 -0.01148 0.05611 0.13701

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.003992 0.010914 -0.366 0.716

VOO_Monthly_Return 1.548548 0.190108 8.146 5.02e-10 ***

---

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

Residual standard error: 0.06942 on 40 degrees of freedom

Multiple R-squared: 0.6239, Adjusted R-squared: 0.6145

F-statistic: 66.35 on 1 and 40 DF, p-value: 5.023e-10