The Vanguard Industrials Index ETF (VIS) touched a 52-week high of $202.86 on Friday, June 16 (Exhibit 1).

Exhibit 1:

|

| Vanguard Industrial Index ETF (VIS) 5-Day Performance Source: Seeking Alpha |

The top performer in this ETF was Vertiv Holdings, returning 133% over the past year (as of June 16, 2023). The company describes itself as follows:

"Vertiv is a global leader in the design, manufacturing and servicing of critical digital infrastructure for data centers, communication networks, and commercial and industrial environments. Our customers operate in some of the world's most critical and growing industries, including cloud services, financial services, healthcare, transportation, manufacturing, energy, education, government, social media, and retail." (Source: SEC.GOV)

This renewed interest in data centers is not surprising, given the popularity of artificial intelligence (AI) and the investments in new applications powered by AI.

In the Q1 2023 Earnings call, Vertiv's management said the following about AI:

"We are distinctly seeing the first signs of the AI investment cycle in our pipelines and orders. Vertiv is uniquely positioned to win here, given our market leadership and deep domain expertise in areas like thermal management and controls, which are vital to support the complexity of future AI infrastructures." (Source: Seeking Alpha)

"Let me go back to the investments in AI. You may have heard it as generally characterized as the next infrastructure arms race, Vertiv benefits from this race and is an agnostic partner of choice to the risk participants. The acceleration in investment in AI will turn into a net infrastructure capacity demand acceleration, and this starts to be visible in our pipeline. AI applications’ demand and net capacity increase in the industry, higher power density, a gradual migration to an air and liquid hybrid cooling environment and a transition to liquid-ready facility designed." (Source: Seeking Alpha)

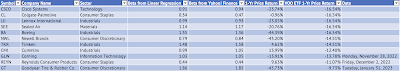

Here's the list of the top 10 performers in the Vanguard Industrials Index ETF over the past year (Exhibit 2).

Exhibit 2:

Top 10 Performers in the Vanguard Industrials Index ETF

Source: Barchart.com, Data Provided by IEX Cloud

Here's the list of the bottom 10 worst performers in the Industrials ETF over the past year (Exhibit 3):

Exhibit 3:

|

| Bottom 10 Worst Performers in the Vanguard Industrials Index ETF Source: Barchart.com, Data Provided by IEX Cloud |