Paccar (PCAR) produced 185,900 trucks in 2022 and is on track for another record year in 2023. The company has experienced good revenue growth in 2021 and 2022. The company has experienced stellar gross and operating margins over the past few years. The company registered a 16% gross and 13% operating margin in 2022. The current fiscal year, 2023, may bring even more good news on the margin front. The company registered a 20% gross and 17% operating margin in its March 2023 quarter and maintained its 17% operating margin in June 2023.

Unfortunately, the demand for trucks may have peaked, given high-interest rates, high inflation, and waning consumer demand. Some of the strength in the truck market was due to the stimulus and subsidies provided by the U.S. Federal Government that bolstered infrastructure spending and brought about a manufacturing renaissance in this country. Although the bills passed by Congress in 2022 have more spending left for a few more years, the weakening consumer and lack of demand in the real estate sector may counteract the spending by the Federal Government. Fiscal year 2023 may be as good as it gets for Paccar. The stock has performed well over the past year, and its dividend yield has fallen. Dividend income seekers may have to wait for a much higher dividend before buying the stock. Treasury rates have increased enough that bonds offer an attractive alternative for investors waiting for a higher yield. Due to these reasons, I rate it a hold.

Exceptional performance of Paccar.

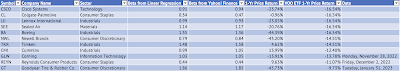

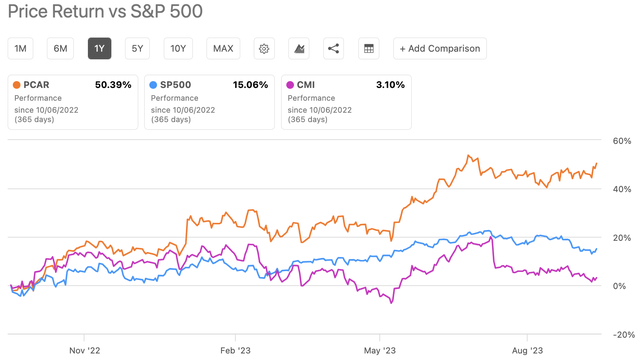

Paccar has performed exceptionally well over the past year, gaining 50% (Exhibit 1). The stock has handily outperformed the S&P 500, which has returned 15% over the past year. Cummins (CMI) gained just 3% over the past year. Year-to-date, the stock has gained 33% compared to the 12% return of the S&P 500 Index (SP500). The Vanguard Industrials Index Fund ETF (VIS) has had a great year, with a return of 16% over the past year. The industrial sector has benefitted from the stimulus and subsidy spending by the U.S. Federal Government. Although more subsidy spending is left in the coming years under the bill authorized by Congress in 2022, a combination of high interest rates and a slowing global economy may cap any upside in this stock.

Exhibit 1:

Performance of Paccar, S&P 500, and Cummins (Seeking Alpha)

Fully valued

Although the stock, trading at a forward GAAP PE of 11.4x, looks undervalued compared to its five-year average of 14.4x, given the economic environment and the rate increase, this lower valuation may be deserved. The Vanguard Industrial Index ETF (VIS) may be overvalued, trading at a weighted average PE of 20x and a price/book ratio of 4x. The EV/EBITDA multiple may better assess the company’s valuation. The stock trades at a 10.2x forward EV/EBITDA multiple compared to the sector median of 10.7x. This indicates the stock may be fully valued. Cummins (CMI), a Paccar peer, looks undervalued, trading at a 7.8x forward EV/EBITDA multiple.

Dividends, buybacks, and debt.

Given the stock's performance over the past year, the yield has dropped to 1.2%. The Vanguard Industrials ETF offers a yield of 1.4%, and the Vanguard S&P 500 Index ETF yields 1.58%. The payout ratio is 12%, a rather conservative number. But, given the cyclical nature of the truck business, Paccar may be suitable to be cautious with its payout. A low payout may also free up cash for stock repurchases. The company paid $483 million in total dividend payments over the trailing twelve months. The company has grown its dividend annually at the pace of 7.5%, compared to 6.8% for the sector, over the past five years.

Paccar has spent $828 million in share buybacks over the past decade. But, the company has issued over $300 million in stock over the past decade, blunting the share buybacks' effects. The diluted share count is reduced from 532.8 million in 2013 to 524.1 million over the trailing twelve months, just 8.7 million. Using this share count reduction, the average price paid for the buybacks is $95 compared to its current price of $86.

The company generated $5.4 billion in EBITDA during the trailing twelve months. Paccar generated $3.5 billion in operating cash and $2.37 billion in free cash flow. This free cash flow number is derived by deducting the company’s capital expenditures from its operating cash. These numbers are good, but investors should remember that 2022 was one of the strongest years for truck demand globally, and 2023 is shaping to be another good year. I am concerned these good times, and any demand reduction could dent its cash flows. Also, the company generates a lot of revenue from its financing division. If the economy slows further and demand wanes, it could increase bad loans and decrease the demand for new loans, as the U.S. Treasury rates have increased to their highest levels in over a decade.

Paccar has performed exceptionally well over the past decade, returning 237% on a total return basis compared to the 210% return of the S&P 500 Index. But, weakening consumers coupled with high rates may put a substantial dent in demand across the various sectors of the economy. The stock’s performance has been impressive, and the industrial sector has been strong over the past year. Most of this strength may be attributed to the various bills passed by the U.S. Congress that have billions of dollars in outlays for renewable energy, electric vehicles, infrastructure modernization, and efforts to re-shore manufacturing and build semiconductor plants. Investors should be concerned that most of the demand across the industrial sector and Paccar is driven not by consumer organic demand but by the government's industrial policy. Paccar’s strength may not last, and it may be best for investors to wait for a much lower entry point.